Internal Fraud Prevention

Prevent internal banking fraud before it happens.

- Ready-to-go AI risk models

- Unrivalled efficiency

- Seamless integration

Global internal fraud losses are estimated at $3.6bn in 2022, with banking and financial services being most affected. In a world of instant payments, banks need to focus on providing a better customer experience by reducing friction in the payment chain. It is becoming increasingly difficult to detect and prevent internal fraud before it impacts your customers and your reputation. Traditional methods that rely on static rules and manual controls are too slow to react. An alternate approach is required, that uses new tools and methods.

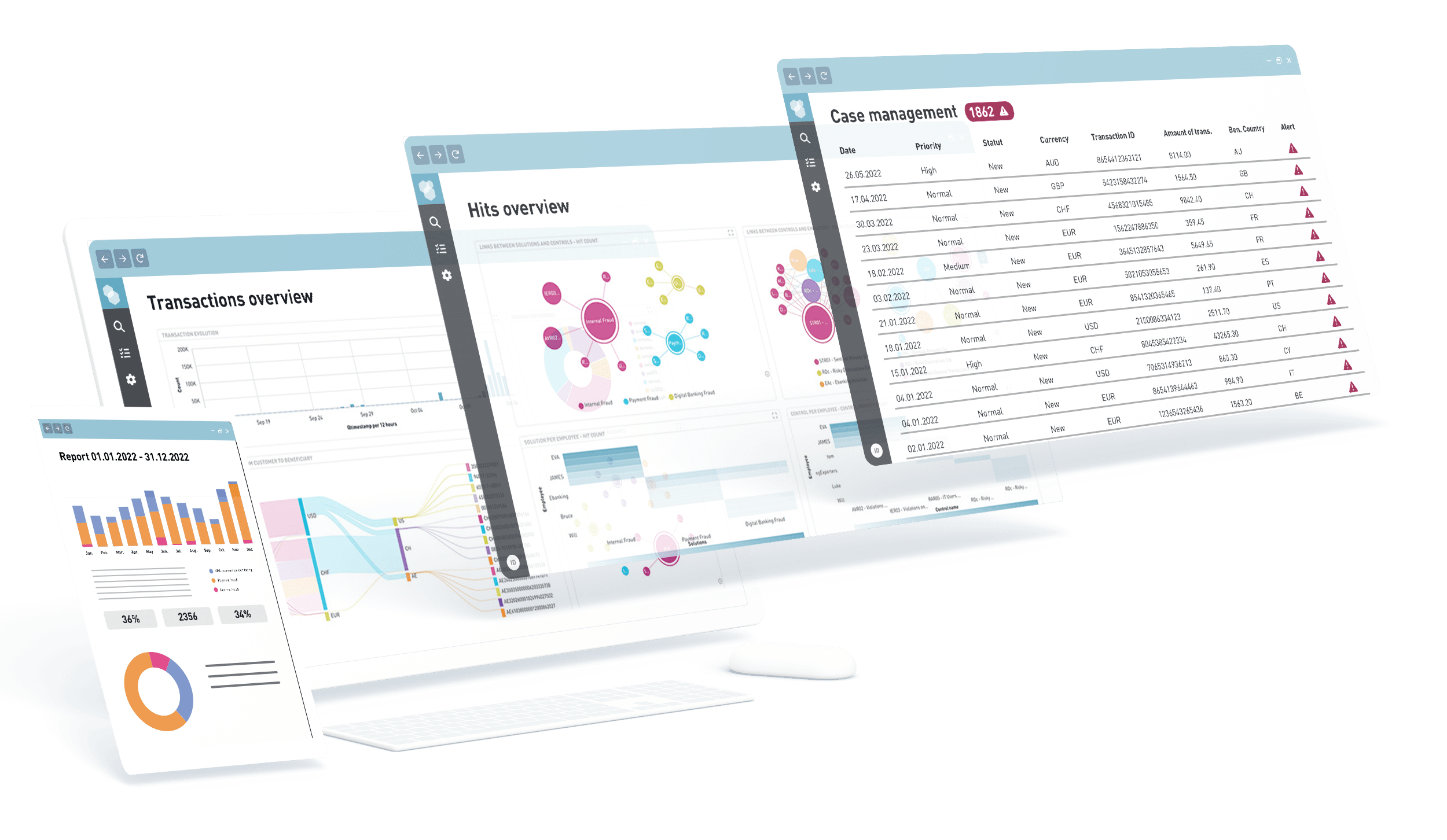

NetGuardians’ Internal fraud solution provides financial institutions with the right tools to track employee behaviour and tie this in with customer transactions. This includes identifying front office/back office control bypass, privileged user abuse (e.g. database administrators & IT administrators) as well as collusion. In the event of a potentially fraudulent transaction that is out-of-profile, it blocks the transaction and triggers a meaningful alert, ready for investigation by the right team.

Banks implementing NetGuardians’ AI solution significantly improve internal fraud management by preventing fraud in a timely manner, reducing the number of false positives and discovering new fraud types.

Connect staff behaviour to resulting customer transactions and analyze this chain using pre-built AI models. Gain confidence by accurately detecting and blocking suspicious transactions before they can impact your customers or affect your reputation. You can monitor across multiple internal source systems (e.g. ERP, core banking, HR systems) and spot and stop internal fraud in real time.

Our AI models do all the heavy lifting, offering deeper insights, reducing false positives and improving operational efficiencies. Alerts are raised in real time, routed to the appropriate team and intuitively contextualized. Explainable AI ensures you can immediately understand every alert.

Standardized and intuitive widget-based dashboards help you visualize, understand and contextualize behaviour, across your employees and customers. Powerful forensic capabilities help you easily and accurately make informed decisions and build effective cases, with supporting documentation and audit trails.

On premise

Flexibility to manage and customize NetGuardians’ solution in-house.

Cloud

Enjoy the benefits of NetGuardians’ fraud prevention solution without internal overhead.