Get it in the cloud

With Swisscom

NG|Cloud Fraud Prevention Service

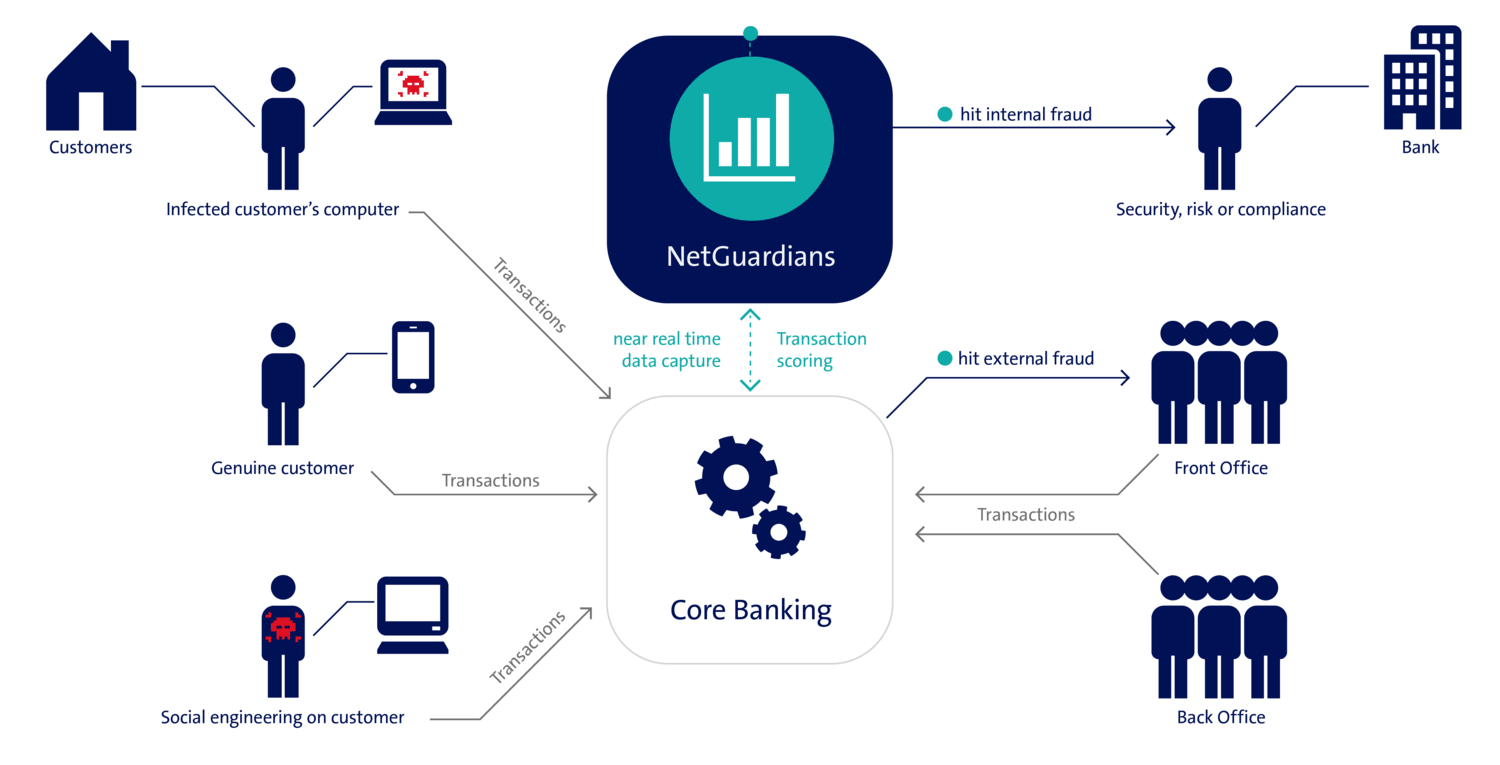

NG|Cloud Fraud Prevention Service is a service provided by Swisscom and NetGuardians that protects your bank system against fraud with the help of artificial intelligence and machine learning. Your customers’ behavior during transactions and your employees’ day-to-day activities are monitored, analyzed and evaluated in real time. Suspicious transactions are therefore blocked and you are immediately notified in risky situations.

This service is offered for banks with Avaloq or Finnova core banking systems hosted in Switzerland.

DISCOVER FRAUD PREVENTION SERVICE BY SWISSCOM’S EXPERT BERNARD HOFMANN

YOUR BENEFITS

With Fraud Prevention Service:

- Suspicious transactions are blocked in real-time: you are immediately alerted to risk situations.

- You can address human risk and cyber fraud

- You can take advantage of a vast network of knowledge to fight fraud

- You have a flexible solution capable of adapting to your needs

- You purchase a turn-key service delivered by Swiss partners

THE SERVICE AS A WHOLE

YOUR SWISSCOM CONTACT