AML transaction monitoring

Monitor transactions and identify truly suspicious behavior while intelligently lowering false positive rates.

Monitor transactions and identify truly suspicious behavior while intelligently lowering false positive rates.

An estimated 2-5% of global GDP is laundered every year. Methods of money laundering are constantly evolving, becoming more sophisticated, faster and difficult to detect.

International regulatory and oversight bodies such as the Financial Action Task Force (FATF) and the Basel Committee on Banking Supervision (BCBS) have continually highlighted the need for more robust AML controls in financial institutions, while regulators have responded with stricter regulation and heftier fines for control failures.

In a world of instant payments with ever-increasing transaction volumes, the detection problem is exacerbated.

Against this backdrop, effective transaction monitoring requires a combination of detecting potentially suspicious behaviour, investigating all resulting alerts and reporting suspicious activity – across your customer base you must be able to intelligently ‘know the good and spot the bad’. It is now time for a new approach and evolved techniques to address this growing transaction monitoring burden.

NetGuardians’ Transaction Monitoring solution helps you accurately detect suspicious transactions whilst intelligently ensuring operational efficiency.

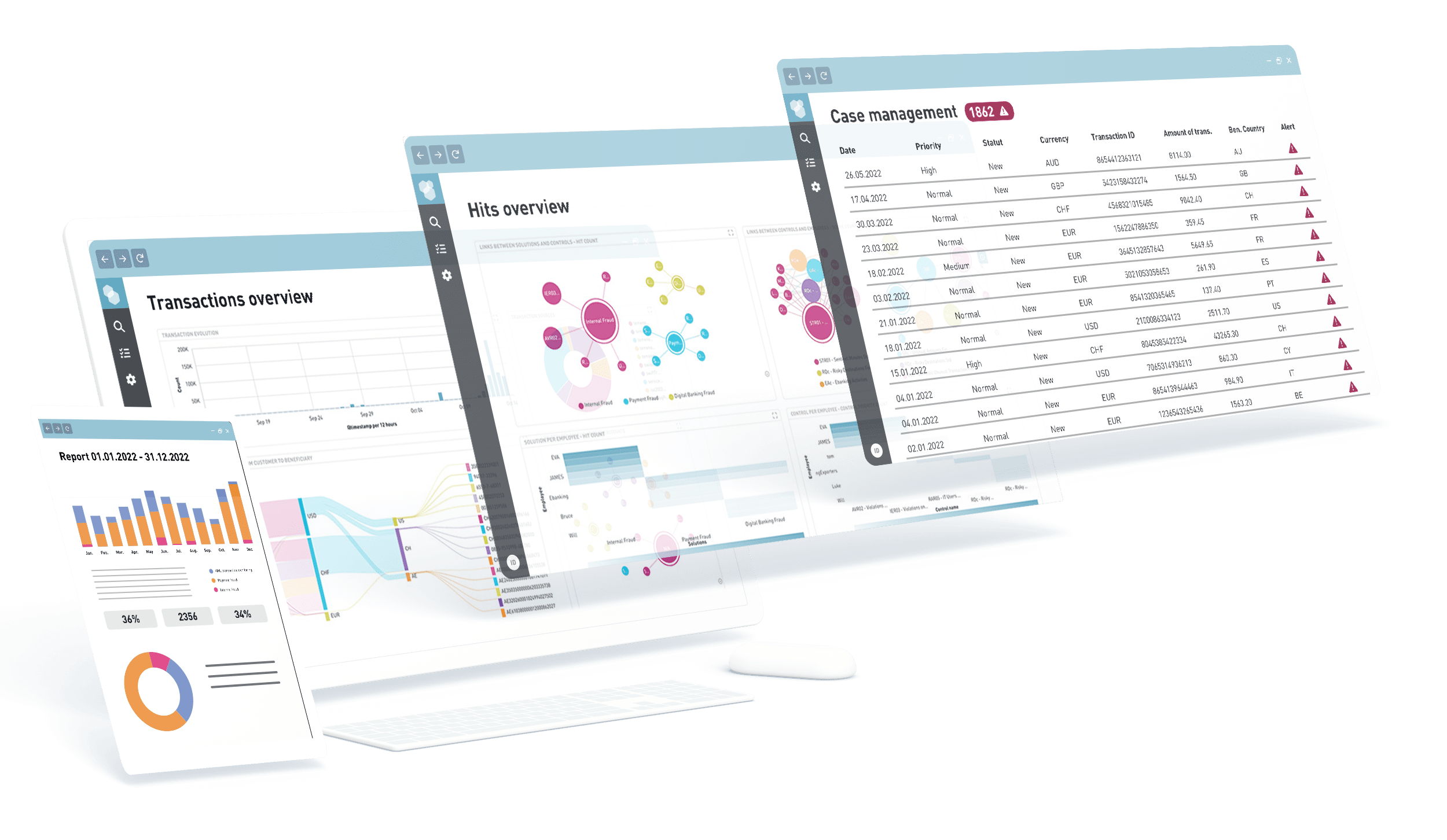

NetGuardians NG|Screener platform integrates internal and external data sources and analyzes these through rules and machine learning to accurately detect potentially suspicious behavior. It can monitor large volumes of transactions in batch or real-time, offering deeper insights, reducing false positives and improving operational efficiencies.

Pre-built rules, profiles and machine learning models are provided as part of the solution. Each of these elements can be easily managed in the ‘Modelling Studio’. This no-code/ low-code tool helps you edit existing detection scenarios, create new scenarios and comprehensively test these in a secure integrated sandbox.

Standardized and intuitive widget-based dashboards help you investigate alerts, vizualise customer and transactional behaviour. You can easily and accurately make informed decisions. If required, you can quickly adjust or extend these dashboards from a widget library. When investigating alerts, explainable AI is on-hand, supported by natural language and visual ‘Evidence Cards’.

Manage and automatically submit your SARs, STRs and CTRs from the integrated reporting feature. Store these safely and securely for follow-up and future reference.

Rapidly activate the solution, achieve superior results and faster ROI. Directly integrate our solution in your transaction flow, in-cloud or on-premise.