Payment Fraud Prevention

Stop payment fraud in real-time.

- Instantly stop fraudulent payments

- Quickly uncover new fraud patterns

- Reduce your false positives

As digital interactions take the lead, instant settlement is the new norm for payment schemes. Fraudsters are stepping up their game, getting more cunning every day. It’s time to act swiftly and stay ahead. You need a proactive approach that identifies both known and emerging fraud patterns, ensuring real-time detection of fraudulent transactions.

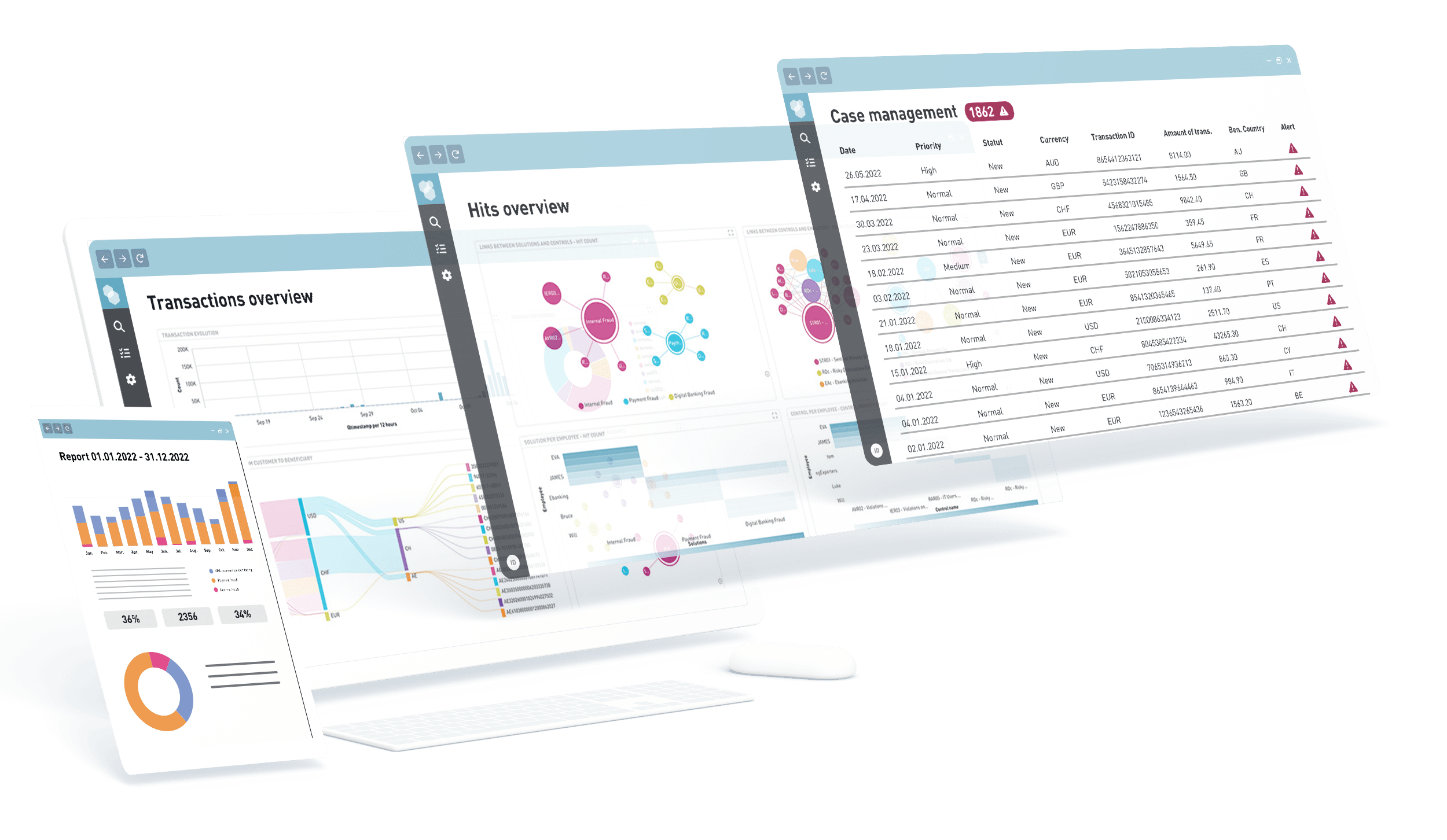

Meet NetGuardians’ payment fraud solution: real-time monitoring, less fraud, and fewer false positives. Pre-built AI models, robust case management, and intuitive investigative dashboards. Detect and stop fraudulent payments from authorized push payment scams, device compromise, account takeover and more. Ensure compliance with SWIFT CSP and PSD2 requirements.

reduction in false positives

savings in operating costs

individuals protected worldwide

NetGuardians’ payment fraud prevention solution integrates within your payment processing flow and analyzes payments through 3D AI risk models to accurately detect suspicious behaviors. It monitors large volumes of transactions in real-time, offering deeper insights, reducing false positives and improving operational efficiencies.

Our AI risk models do all the heavy lifting. Forget complex and expensive data science projects. These pre-built models more accurately detect fraud with lower false positives, helping you to quickly start preventing fraud. By continually learning and through feedback, the models keep your fraud prevention controls optimized and relevant, even when facing changing threats.

Alerts are raised in real time, routed to the appropriate team and intuitively contextualized. Explainable AI, supported by natural language visual ‘Evidence Cards’ ensures you can immediately understand every alert. You can even target and automate customer callbacks.

Standardized and intuitive widget-based dashboards help you visualize, understand and contextualize transactional behavior. Powerful forensic capabilities help you easily and accurately make informed decisions. If required, you can quickly adjust or extend these dashboards from a widget library.

“Our main requirements were to detect more fraud with a flexible system that would throw up fewer false positives. We were getting about 800 false alerts a day. With NetGuardians we have cut that and are stopping more fraud.”

Romano Ramanti, Ethical Hacker at Zürcher Kantonalbank

“Within seven months, NetGuardians’ payment fraud solution had analyzed more than five million transactions yet blocked 10 times fewer payments than Aargauische Kantonalbank’s former system and achieved a better fraud detection rate.”

René Burger, Head of Payment Projects, Aargauische Kantonalbank

NetGuardians’ AI-based solution allows banks to monitor SWIFT messages to spot fraudulent payments in real time, helping them meet SWIFT Customer Security Program (CSP) requirements.

“With our proprietary banking platform, we want to make sure that we have cutting edge fraud-prevention systems in place to protect our clients and their assets. We constantly invest to stay at the forefront of technological developments and therefore forge partnerships, especially with Swiss FinTechs. NetGuardians’ software solution complements our infrastructure solutions to reinforce advanced fraud mitigation.”

Geoffroy De Ridder, Head of Technology and Operation at Lombard Odier.

“Everything we do is for our customers. By working with NetGuardians we will be able to give them the best protection against fraudsters and improve our service to them. The accuracy of the software means we will only contact them when a transaction is highly likely to be fraud. This has two benefits – we will stop more fraud and contact our customers less often. It’s a win-win.”

Christoph Schaer, Chief Operating Officer at BLKB

“At Swissquote, we want our customers to know we are doing everything we can to prevent fraud. NetGuardians offers one of the best financial crime solutions on the market, helping us to quickly identify and stop scammers and money launderers. This means our customers can bank with confidence at Swissquote.”

Lino Finini, COO of Swissquote.

“Our partnership with NetGuardians delivers good benefits, especially for fraud in the digital space. You need smart solutions to assist in the fight against fraud to get the right alerts. We know we get this from NetGuardians.”

Michael Amoah, Head of Internal Control, Consolidated Bank Ghana

On premise

Flexibility to manage and customize NetGuardians’ solution in-house.

Cloud

Enjoy the benefits of NetGuardians’ fraud prevention solution without internal overhead.